Exploring the crucial link between financial planning and achieving a harmonious work-life balance, this guide delves into the strategies and techniques that can transform your approach to managing both personal and professional aspects of life. By understanding the impact of financial stability on overall well-being, you can embark on a journey towards a more fulfilling and balanced lifestyle.

The Importance of Financial Planning in Work-Life Balance

Financial planning plays a crucial role in achieving work-life balance by providing a sense of security and stability in both personal and professional life. When individuals have a clear financial roadmap, they can make informed decisions that align with their priorities and goals, leading to reduced stress and better overall well-being.

Financial Stability and Stress Reduction

Proper financial planning can significantly reduce stress levels by ensuring that individuals have enough savings to cover unexpected expenses, emergencies, or periods of financial instability. For example, having an emergency fund in place can provide a buffer during challenging times, allowing individuals to focus on work and personal life without constantly worrying about financial issues.

Mental Well-being and Happiness

Financial stability is closely linked to mental well-being and overall happiness. When individuals feel secure about their financial situation, they are less likely to experience anxiety or depression related to money matters. This sense of security allows them to fully engage in work and personal relationships, leading to a more fulfilling and balanced life.

Strategies for Incorporating Financial Planning into Daily Routine

Integrating financial planning tasks into a busy schedule is crucial for maintaining a healthy work-life balance. By setting aside dedicated time for financial planning activities, individuals can ensure their financial well-being and reduce stress related to money management.

Utilize Technology for Financial Planning

One effective strategy is to leverage technology and apps to simplify financial planning processes. There are numerous tools available that can help track expenses, create budgets, set financial goals, and monitor investments. By utilizing these resources, individuals can streamline their financial tasks and stay organized.

Establish a Routine for Financial Check-Ins

Another practical tip is to establish a routine for regular financial check-ins. Whether it’s a weekly review of expenses or a monthly assessment of savings goals, setting aside time to evaluate your financial status can help you stay on track and make necessary adjustments.

Automate Savings and Investments

Automating savings and investments is a great way to ensure that you are consistently putting money aside for the future. By setting up automatic transfers to your savings account or investment portfolio, you can prioritize financial goals without having to remember to do it manually.

Set Specific Financial Goals

Setting specific, measurable financial goals can provide motivation and direction for your financial planning efforts. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having clear objectives can help you stay focused and disciplined in your financial decisions.

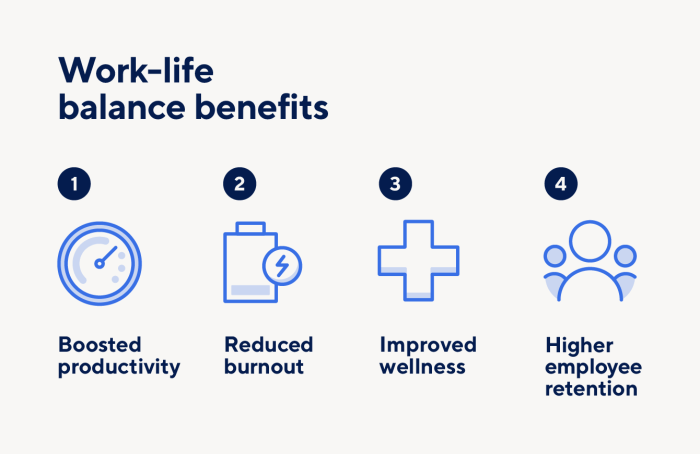

Budgeting Techniques for Enhancing Work-Life Balance

Budgeting is a crucial tool that can help individuals achieve a better work-life balance by managing their finances effectively. By implementing various budgeting methods, individuals can make informed decisions about their work and personal life, leading to a more balanced and fulfilling lifestyle.

Short-Term vs. Long-Term Budgeting Strategies

- Short-Term Budgeting: Short-term budgeting involves creating a budget for a specific period, usually monthly or quarterly. This type of budgeting allows individuals to track their expenses and income more closely, making adjustments as needed to ensure financial stability in the short term.

- Long-Term Budgeting: Long-term budgeting focuses on setting financial goals for the future, such as saving for retirement, buying a house, or paying off debt. By creating a long-term budget, individuals can plan ahead and allocate resources efficiently to achieve their financial objectives, leading to a more secure and balanced life.

Budgeting Empowerment for Informed Decision-Making

- Example 1: By creating a budget, individuals can identify areas where they may be overspending, allowing them to make adjustments to prioritize their expenses and save more effectively. This can empower individuals to make informed decisions about their work commitments and personal life, ensuring that they allocate time and resources according to their priorities.

- Example 2: Budgeting can also help individuals plan for unexpected expenses, such as medical emergencies or car repairs, reducing financial stress and allowing them to focus on both their work and personal responsibilities without worrying about money. This sense of financial security can lead to a better work-life balance, as individuals can navigate challenges more effectively and maintain stability in their daily lives.

Financial Goals Setting and Alignment with Work-Life Balance

Setting financial goals is crucial in achieving work-life balance as it provides a clear roadmap for managing your finances effectively. By establishing specific goals, you can prioritize where you allocate your resources, ensuring that your financial decisions align with your overall objectives.

Importance of Aligning Financial Goals with Personal Values

Aligning financial goals with personal values and priorities can lead to a more fulfilling life by ensuring that your money is being used in a way that resonates with what matters most to you. When your financial goals are in sync with your values, you are more likely to feel a sense of purpose and satisfaction in your financial decisions.

Tips for Adjusting Financial Goals as Life Circumstances Change

Life is dynamic, and as circumstances change, it is essential to adjust your financial goals to maintain work-life balance. Be flexible and willing to reassess your goals periodically to ensure they continue to reflect your current situation and priorities. Consider factors such as career changes, family obligations, and personal growth when revisiting and adjusting your financial goals.

Last Word

In conclusion, prioritizing financial planning as a tool for achieving work-life balance can pave the way for a more secure and content existence. By incorporating budgeting techniques, setting clear financial goals, and aligning them with personal values, individuals can navigate the complexities of modern life with confidence and clarity.

Start your journey towards a balanced life today by taking charge of your financial future.

FAQ

How does financial planning impact work-life balance?

Financial planning provides a sense of security and control over one’s finances, reducing stress and allowing individuals to focus on both work and personal life with greater peace of mind.

What are some practical tips for integrating financial planning into a busy schedule?

Some tips include setting aside dedicated time for financial tasks, using technology and apps to streamline the process, and prioritizing financial activities alongside other daily responsibilities.

Why is aligning financial goals with personal values important?

Aligning financial goals with personal values ensures that individuals are working towards objectives that truly matter to them, leading to a more fulfilling and purpose-driven life.