Embarking on the journey of Commercial Auto Policy Renewal Guide for Fleet Owners, this guide offers insight and guidance in a manner that is both informative and engaging.

In the following sections, we will delve into the key aspects surrounding commercial auto policy renewals for fleet owners, shedding light on essential information to streamline the process.

Overview of Commercial Auto Policy Renewal Guide for Fleet Owners

A commercial auto policy renewal guide for fleet owners is a comprehensive document that Artikels the process and requirements for renewing commercial auto insurance policies. It serves as a valuable resource for fleet owners to ensure they meet all necessary obligations and maintain adequate coverage for their vehicles.

Importance of Renewing Commercial Auto Policies

Renewing commercial auto policies is crucial for fleet owners to protect their businesses, drivers, and assets in the event of accidents or unforeseen circumstances. Without proper insurance coverage, fleet owners may face financial losses and legal liabilities that can have a significant impact on their operations.

Key Components of a Commercial Auto Policy Renewal Guide

- Policy Renewal Process: Details on how to renew the policy, including deadlines and required documentation.

- Coverage Options: Overview of different coverage options available for commercial auto insurance and their benefits.

- Premium Payments: Information on premium amounts, payment methods, and due dates for renewing the policy.

- Policy Updates: Instructions on how to make changes or updates to the policy, such as adding or removing vehicles or drivers.

- Claims Process: Explanation of the claims process and how to file a claim in case of an accident or damage to a vehicle.

Understanding Policy Renewal Process

When it comes to renewing a commercial auto policy for fleet owners, it is crucial to follow a specific step-by-step process to ensure a smooth transition and continuation of coverage. Here is a breakdown of the key points to consider during the policy renewal process.

Documents Required for Policy Renewal

- Current Insurance Policy: Fleet owners need to provide their current insurance policy details to the insurance provider for reference during the renewal process.

- Vehicle Information: A list of all vehicles in the fleet, including make, model, year, and VIN numbers, must be submitted for accurate policy renewal.

- Driver Information: Details of all drivers operating the fleet vehicles, including licenses and driving records, are essential for policy renewal.

- Claims History: Any past claims made by the fleet owner or drivers should be disclosed to the insurance provider for a comprehensive policy review.

Timeline for Policy Renewal

- Advance Notice: Insurance providers typically send out renewal notices to fleet owners well in advance of the policy expiration date to allow for ample time to review and renew.

- Review Period: Fleet owners should carefully review the renewal terms and conditions, assess any changes in coverage or premiums, and address any concerns before the renewal deadline.

- Renewal Deadline: It is important to adhere to the renewal deadline set by the insurance provider to avoid any lapses in coverage or potential policy cancellations.

Coverage Options for Fleet Owners

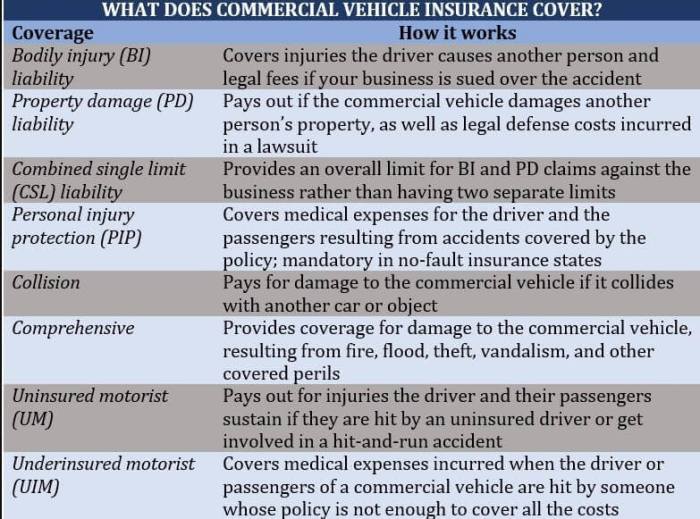

When it comes to renewing a commercial auto policy for fleet owners, there are several coverage options to consider. Each option provides a different level of protection for your vehicles and drivers, so it’s important to understand the benefits of each.

Liability Coverage

Liability coverage is a fundamental part of any commercial auto policy. It helps protect fleet owners from financial loss in case their vehicles are involved in an accident that causes property damage or bodily injury to others. This coverage is essential for fleet owners to meet legal requirements and protect their assets in case of a lawsuit.

Collision Coverage

Collision coverage helps pay for repairs to fleet vehicles in case of an accident, regardless of who is at fault. This coverage can be especially beneficial for fleet owners who want to ensure their vehicles are repaired quickly and back on the road to minimize downtime.

Comprehensive Coverage

Comprehensive coverage protects fleet vehicles from non-collision related incidents, such as theft, vandalism, or natural disasters. This coverage can be valuable for fleet owners who want to protect their vehicles from a wide range of risks beyond just accidents.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage helps cover costs if one of your fleet vehicles is involved in an accident with a driver who doesn’t have insurance or enough insurance to cover the damages. This coverage can be crucial for fleet owners to avoid financial losses in situations where the other party is unable to pay for the damages.

Rental Reimbursement Coverage

Rental reimbursement coverage can help fleet owners cover the cost of renting a replacement vehicle while their primary vehicles are being repaired after an accident. This coverage can be beneficial for fleet owners who rely on their vehicles for daily operations and can’t afford to have them out of commission for an extended period.

Conclusion

Choosing the right coverage options for your fleet can make a significant difference in protecting your business and assets. By understanding the various coverage options available and their benefits, fleet owners can make informed decisions during the policy renewal process.

Factors Affecting Policy Renewal

When it comes to renewing a commercial auto policy for fleet owners, several factors come into play that can impact the decision-making process. These factors can range from claims history to the types of vehicles in the fleet and even the overall size of the fleet.

Understanding these factors is crucial for fleet owners to ensure a smooth and favorable policy renewal process.

Claims History

Maintaining a clean claims history is essential for fleet owners looking to secure a favorable policy renewal. Insurance companies assess the number and severity of past claims when determining renewal terms. A history of frequent or costly claims can lead to higher premiums or even denial of coverage.

Fleet owners should prioritize safe driving practices and thorough maintenance to minimize claims and demonstrate their commitment to risk management.

Vehicle Types

The types of vehicles in a fleet can also impact policy renewal decisions. Insurance companies consider the make, model, age, and usage of each vehicle when calculating premiums. Vehicles with a higher risk of accidents or theft may result in increased insurance costs.

Fleet owners should regularly review their vehicle inventory and consider retiring or replacing older or high-risk vehicles to maintain affordable insurance rates.

Fleet Size

The size of a fleet can play a significant role in policy renewal negotiations. Larger fleets may face different challenges compared to smaller fleets, such as managing multiple drivers, vehicles, and routes. Insurance companies may offer volume discounts for larger fleets but also require more robust risk management practices.

Fleet owners should ensure proper documentation, training programs, and safety protocols are in place to showcase their ability to effectively manage a large fleet.

Maintaining a Favorable Renewal Status

To maintain a favorable renewal status, fleet owners should proactively address potential risk factors before policy renewal. This includes implementing safety protocols, conducting regular vehicle maintenance, providing driver training, and monitoring claims closely. By demonstrating a commitment to risk management and safety, fleet owners can improve their chances of securing competitive insurance rates and favorable policy terms.

Cost Considerations

When it comes to renewing a commercial auto policy for fleet owners, understanding the cost implications is crucial. The pricing factors that determine the cost of policy renewal can vary based on several key elements. Here, we will break down these factors and offer strategies for fleet owners to potentially reduce costs during policy renewal.

Pricing Factors for Policy Renewal

- Number of Vehicles: The more vehicles in your fleet, the higher the insurance premium is likely to be. Insurers consider the size of your fleet when calculating the cost of renewal.

- Vehicle Types: The types of vehicles in your fleet, such as trucks, vans, or cars, can impact the cost of renewal. Typically, larger or more specialized vehicles may come with higher premiums.

- Driving History: The driving record of your fleet drivers plays a significant role in determining the cost of policy renewal. A history of accidents or violations can lead to increased premiums.

- Coverage Limits: The coverage limits you choose for your fleet also affect the cost of renewal. Higher coverage limits generally result in higher premiums.

- Location and Usage: The location where your fleet operates and the frequency of vehicle use can impact renewal costs. Urban areas or high-traffic regions may lead to higher premiums.

Strategies to Reduce Costs

- Driver Training Programs: Implementing driver training programs can help improve the driving behavior of your fleet drivers, potentially reducing accidents and lowering insurance costs.

- Fleet Maintenance: Regular maintenance of fleet vehicles can help prevent breakdowns and accidents, leading to potential cost savings on insurance premiums.

- Shop Around: Compare quotes from different insurers to ensure you are getting the best deal for your fleet. Don’t hesitate to negotiate or ask for discounts.

- Risk Management: Implementing risk management practices within your fleet operations can demonstrate to insurers that you are proactive in minimizing risks, which may result in lower premiums.

Compliance and Legal Requirements

In the world of fleet ownership, compliance with legal requirements is crucial during the policy renewal process. Ensuring that fleet owners meet all necessary standards, regulations, and laws is essential to maintaining a successful and legally sound operation.

Regulatory Standards for Commercial Auto Policy Renewals

- One of the key legal requirements for fleet owners during policy renewal is ensuring that all vehicles in the fleet meet state and federal regulations for commercial vehicles.

- Fleet owners must also comply with any specific industry standards or regulations that may apply to their type of business or the goods they transport.

- It is important to stay up to date with any changes in regulations that may impact commercial auto policy renewals to avoid any legal issues.

Ensuring Compliance with Legal Obligations

- Regularly reviewing and updating policies and procedures to align with current regulations is essential for fleet owners to remain compliant.

- Training staff on compliance requirements and ensuring they understand their roles in maintaining legal standards can help prevent violations during policy renewals.

- Working with legal advisors or consultants who specialize in commercial auto regulations can provide valuable guidance and support in navigating the complex legal landscape.

Ending Remarks

As we wrap up our discussion on Commercial Auto Policy Renewal Guide for Fleet Owners, we hope the insights shared have equipped you with valuable knowledge for the renewal process. Stay informed and proactive to ensure a smooth policy renewal experience.

Expert Answers

What documents are needed for commercial auto policy renewal?

Commonly required documents include proof of insurance, vehicle registration, and driver information.

How can fleet owners reduce costs during policy renewal?

Fleet owners can explore options like adjusting coverage levels, improving safety measures, or bundling policies to potentially lower costs.

What factors can impact the renewal of a commercial auto policy?

Factors such as claims history, fleet size, and the types of vehicles in the fleet can influence policy renewal decisions.